What is idea screening?

Idea screening is a process of identifying the most promising ideas or concepts that have the potential to resonate with consumers.

Basically, idea screening is like an ultimate superhero that saves businesses from launching innovations that fail to make a mark on the consumers.

The goal of idea screening is to narrow down the pool of ideas to a select few that have the greatest potential for further development and commercialization. This helps organizations allocate their resources effectively and focus on good ideas most likely to generate positive outcomes.

When would you use idea screening?

Idea screening is typically used in the early stages of product development when an organization has brainstormed a bunch of ideas. It's a great tool to assess and filter these ideas to determine which ones have the greatest potential for success.

Here are some of the common scenarios when you would typically use idea screening:

New product development: If you're launching a new product, service or solution, idea screening can help you find the concepts that align best with your goals, target audience, and market demand.

Package design and creative testing: Want to create packaging or marketing materials that will make your product stand out? Idea screening is perfect for testing creatives and pack designs against the competition.

Message and claims optimization: If you want to grab people's attention with compelling claims on your website, packaging or other marketing collateral, idea screening will help you find the right words.

Other innovation initiatives: If you want to disrupt the market or gain a competitive advantage, early-stage idea screening can help you evaluate and prioritize innovative ideas.

Portfolio management: For companies with an existing portfolio of products or services, idea screening can help you evaluate new ideas that can complement or enhance your existing offerings.

Upsiide’s idea screening methodology

Upsiide's Idea Screening methodology was designed to predict in-market performance of a product.

It's inspired by the swiping methodologies of social media, making the experience fast, easy, and even enjoyable - sort of like a game.

Reinventing the respondent experience

How do the respondents answer questions about your ideas on Upsiide?

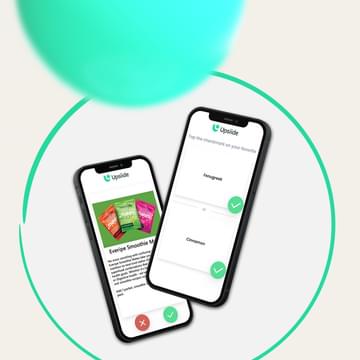

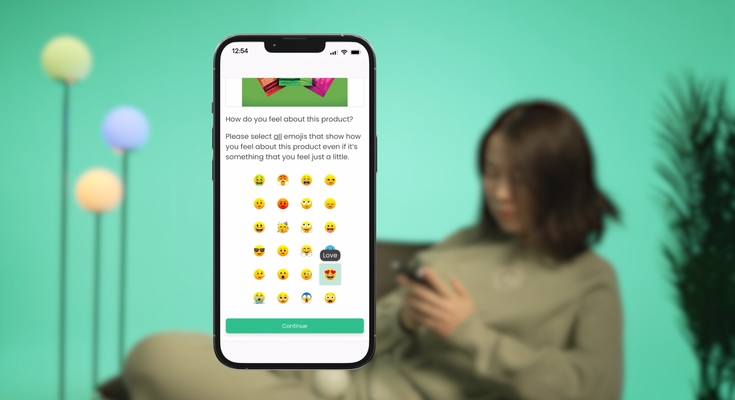

We've leveraged the intuitive swiping methodology that's pervasive on mobile (Tinder, anyone?) and used it to gauge respondents' interest and engagement with statements, images, logos, and more.

Respondents see each idea individually. If they like the idea, they swipe right. If they don't like it, they swipe left.

Here's where it get's interesting. Once a respondent has liked (or swiped right on) two ideas, they'll be faced with a head-to-head or commitment scenario: which of the two ideas do they prefer?

This forced choice methodology is crucial to determining the winning idea. It also evaluates ideas in context and allows for a more accurate assessment of their potential against other things you could launch or against other in-market offerings.

Not to mention it makes for a thoroughly engaging and gamified respondent experience.

What data is used in idea screening

When you run an Idea Screen on Upsiide, there are three main data points to explore in your results.

Interest Score:

This is the proportion of people who liked an idea. The Interest Score is a percentage score.

Commitment Score:

After choosing the ideas, respondents are asked to trade off between the ideas they liked and pick a favourite. The Commitment Score is also a percentage score.

Idea Score:

This is a composite metric - so, an absolute score - that's been calibrated to predict sales in-market. The Idea Score is based on a combination of Interest Score and Commitment Score.

Though it might sound simple, we fine-tuned the relative weights of the Interest and Commitment Scores (using the Hierarchical Bayesian (HB) Linear Model) and consistently validated them with in-market realities. This resulted in an optimized Idea Score, a brand-new metric that will help you predict sales volumes.

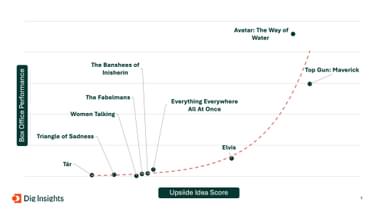

Proof of Idea Score's Predictive Power

Okay, it's pretty bold to say that we can predict the success of a product in advance. But hey, we've got proof!

In March 2023, before the Academy Awards ceremony, we asked a representative sample of 200 Americans aged 18+ to complete an Idea Screen exercise on the Best Picture nominees for the 2023 Oscars.

The results – Idea Score and box office performance correlate with 0.88. That means the films that were rated highest by our panel of the general public also performed the best at the box office. So here’s your proof that Upsiide can predict winning ideas in advance!

Of course, we know that Everything Everywhere All at Once won best film. It deserved to win; it was an awesome film. But it wasn't the winner at the box office or in our idea screening.

Even though the Academy of Motion Picture Arts and Sciences are expert in their field, they don’t know what will actually bring the most money.

That’s why we always say that internal client teams shouldn’t assume what’s best for the market - they aren’t real consumers putting down their hard-earned cash.

Read more: How Upsiide Can Predict The Success of Your Idea: An Oscars Case Study.

Using Upsiide for your idea screening

Upsiide is a brainchild of people at Dig Insights, an insights & strategy consultancy. The market research experts at Dig created Upsiide’s idea screening tool to...

Screen as many ideas as they want, identifying high-potential opportunities

Develop and optimize the best innovations vs. in-market competitors, determining items that can grow business

Assess the finalized ideas, conduct deep diagnostics and create volume projections

Here are 3 pillars on which Dig created Upsiide's Idea Screening tool

Every category is impulse

Consumers make countless decisions every day, often in a matter of seconds. These decisions are influenced by ingrained heuristics, developed and refined over the years.

That's why our idea screen interface captures this rapid decision-making process, inspired by how people use social media. We leverage swiping methodology that's pervasive on mobile, making the experience fast, easy, and fun.

Choice requires context

Upsiide only evaluates ideas in context. Respondents see each idea individually. If they like the idea, they swipe right. If they don't like it, they swipe left. Once a respondent has liked two ideas, they are asked to trade-off between the two and choose their favorite.

This gamified exercise allows us to put ideas in context against other things you could launch or against other in-market offerings. It's like playing a game of "Would You Rather" but for product ideas!

Knowledge is not power

Having the right data does not make you a change leader. Effective action makes you a change leader. That's why our Idea Screening interface helps you get the right data through meaningful real-time reporting that leverages four interactive, intuitive dashboards. These dashboards allow your team to "play" with the data and, through play, to be inspired by the data.

Sophisticated Data Visualization is Built-In

If Upsiide produced nothing more than an Interest Score, Commitment Score, and an Idea Score, it would be a useful idea screening tool. But we weren't satisfied with "useful". One of the benefits of using a tool built by Dig Insights is that we understand how to model and visualize data.

Upsiide's Idea Screening Tool In Action

With the drastic changes that COVID brought, Pizza Hut's marketing team needed an agile platform to help them land on the right creative for marketing campaigns. Luckily, Upsiide stepped up to the "plate".

Pizza Hut used Upsiide's idea screening methodology to validate new menu ideas, adjust messaging and menu items, and optimize claims for limited-time offers and other marketing initiatives.

The team found Upsiide extremely valuable for two reasons: using the platform has dramatically reduced time spent assessing different innovation ideas and reduced the cost of innovation research.

We saved a lot of money. Before, if we wanted to test 30 ideas, we would spend thousands of dollars. And the amount of waiting time would mean weeks lost. Upsiide saved us time so we could act on key insights quickly - while saving valuable budget.